Surety Bond Qualifications . In the case of surety bonds, the. learn how to qualify for a surety bond. surety bond insurance serves a dual purpose: as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. how to qualify for a bond. Ensuring legal compliance and guaranteeing contract fulfilment. This guide includes what you’ll need to apply, key eligibility requirements and tips to. a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond. surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the surety. The owner has the assurance.

from www.templateroller.com

Ensuring legal compliance and guaranteeing contract fulfilment. The owner has the assurance. a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond. Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. surety bond insurance serves a dual purpose: as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. This guide includes what you’ll need to apply, key eligibility requirements and tips to. In the case of surety bonds, the. how to qualify for a bond. surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the surety.

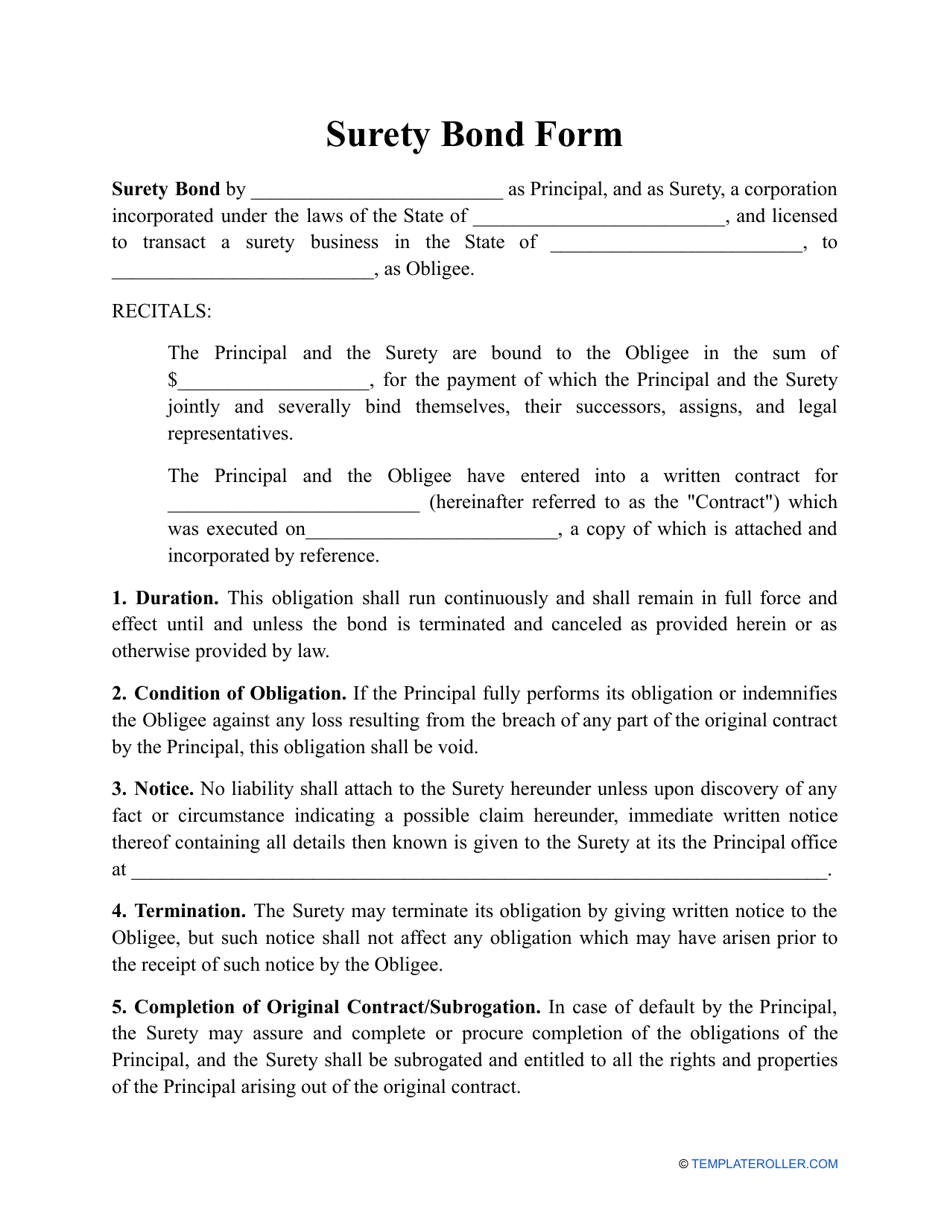

Surety Bond Form Fill Out, Sign Online and Download PDF Templateroller

Surety Bond Qualifications how to qualify for a bond. Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. This guide includes what you’ll need to apply, key eligibility requirements and tips to. how to qualify for a bond. as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. learn how to qualify for a surety bond. In the case of surety bonds, the. surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the surety. surety bond insurance serves a dual purpose: The owner has the assurance. Ensuring legal compliance and guaranteeing contract fulfilment. a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond.

From surety007.com

Surety Bonds Conditional and Unconditional Surety 007 Surety Bond Qualifications how to qualify for a bond. surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the surety. a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond. learn how to qualify for a surety bond.. Surety Bond Qualifications.

From executivesuretybonds.com

California Motor Vehicle Dealer (10,000) Bond Surety Bond Qualifications surety bond insurance serves a dual purpose: surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the surety. a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond. This guide includes what you’ll need to apply,. Surety Bond Qualifications.

From www.suretybondsdirect.com

What is a Surety Bond? Surety Bonds Explained. Surety Bond Qualifications surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the surety. The owner has the assurance. surety bond insurance serves a dual purpose: In the case of surety bonds, the. This guide includes what you’ll need to apply, key eligibility requirements and tips to. learn how to qualify for a surety bond.. Surety Bond Qualifications.

From www.scribd.com

Sample Surety Bond Surety Bond Business Law Surety Bond Qualifications as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. learn how to qualify for a surety bond. a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond. In the case of. Surety Bond Qualifications.

From www.suretybondsdirect.com

How To Get A Surety Bond In 3 Easy Steps Surety Bond Qualifications how to qualify for a bond. Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. Ensuring legal compliance and guaranteeing contract fulfilment. This guide includes what you’ll need to apply, key eligibility requirements and tips to. surety bond insurance serves a dual purpose: learn how to qualify for a. Surety Bond Qualifications.

From executivesuretybonds.com

California Process Server Bond 2,000 Surety Bond Qualifications how to qualify for a bond. The owner has the assurance. surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the surety. Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. This guide includes what you’ll need to apply, key eligibility requirements and tips to.. Surety Bond Qualifications.

From executivesuretybonds.com

Contra Costa, CA Well Driller Performance 5,000 Bond Surety Bond Qualifications In the case of surety bonds, the. as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the. Surety Bond Qualifications.

From suretysolutions.com

License and Permit Surety Bond Form Example Surety Solutions, A Surety Bond Qualifications surety bond insurance serves a dual purpose: Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. This guide includes what you’ll need to apply, key eligibility requirements and tips to. surety bonds are financial instruments that tie the principal, the obligee—often a government entity—and the surety. as an impartial. Surety Bond Qualifications.

From okcinsurancebrokers.com

What Is a Surety Bond? Everything You Need to Know About This Financial Surety Bond Qualifications Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. The owner has the assurance. how to qualify for a bond. learn how to qualify for a surety bond. as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. surety. Surety Bond Qualifications.

From www.thebailboys.com

What is a Surety Bond as it Relates to Jail and Bail Bonds? Surety Bond Qualifications surety bond insurance serves a dual purpose: learn how to qualify for a surety bond. In the case of surety bonds, the. as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. This guide includes what you’ll need to apply, key eligibility requirements and tips to. Surety bond. Surety Bond Qualifications.

From www.liconstructionlaw.com

What is a Surety Bond and When is it Used? Surety Bond Qualifications how to qualify for a bond. surety bond insurance serves a dual purpose: as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. learn how to qualify for a surety bond. Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past. Surety Bond Qualifications.

From executivesuretybonds.com

California Insurance Adjuster (2,000) Bond Surety Bond Qualifications The owner has the assurance. a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond. as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. surety bond insurance serves a dual purpose:. Surety Bond Qualifications.

From axcess-surety.com

Washington Notary Bond Surety Bonds by Axcess Surety Bond Qualifications a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond. Ensuring legal compliance and guaranteeing contract fulfilment. The owner has the assurance. Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. learn how to. Surety Bond Qualifications.

From www.suretybonds.com

How to Obtain a Surety Bond [Infographic] Surety Bond Insider Surety Bond Qualifications how to qualify for a bond. learn how to qualify for a surety bond. as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. In the case of surety bonds, the. a surety bond is a written agreement that guarantees a task or service will be completed. Surety Bond Qualifications.

From www.suretybondsdirect.com

How Long Does It Take To Get a Surety Bond? Surety Bond Qualifications as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and qualified. The owner has the assurance. This guide includes what you’ll need to apply, key eligibility requirements and tips to. surety bond insurance serves a dual purpose: how to qualify for a bond. Surety bond underwriting is a form. Surety Bond Qualifications.

From www.suretybondsdirect.com

Everything You Need to Know About Surety Bonds & A Letter of Credit Surety Bond Qualifications Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,. a surety bond is a written agreement that guarantees a task or service will be completed in accordance with the terms spelled out in the bond. The owner has the assurance. surety bond insurance serves a dual purpose: how to. Surety Bond Qualifications.

From www.templateroller.com

Surety Bond Form Fill Out, Sign Online and Download PDF Templateroller Surety Bond Qualifications learn how to qualify for a surety bond. how to qualify for a bond. The owner has the assurance. This guide includes what you’ll need to apply, key eligibility requirements and tips to. surety bond insurance serves a dual purpose: Surety bond underwriting is a form of credit analysis that focuses on an evaluation of past performance,.. Surety Bond Qualifications.

From www.educba.com

Surety Bond How does Surety Bond work with Example and FAQ? Surety Bond Qualifications Ensuring legal compliance and guaranteeing contract fulfilment. This guide includes what you’ll need to apply, key eligibility requirements and tips to. how to qualify for a bond. surety bond insurance serves a dual purpose: The owner has the assurance. as an impartial third party, the surety prequalifies the contractor to verify that the contractor is capable and. Surety Bond Qualifications.